free cash flow yield plus growth

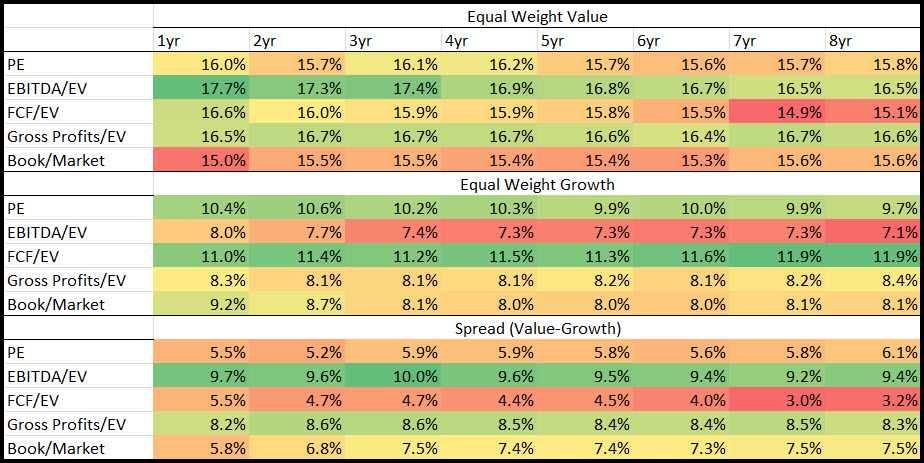

If a company is earning above its cost of capital free cash flow yield plus growth is a good rough proxy for expected. 2022 was 055.

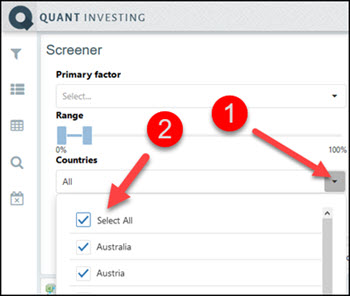

Why And How To Implement A High Free Cash Flow Yield Investment Strategy Quant Investing

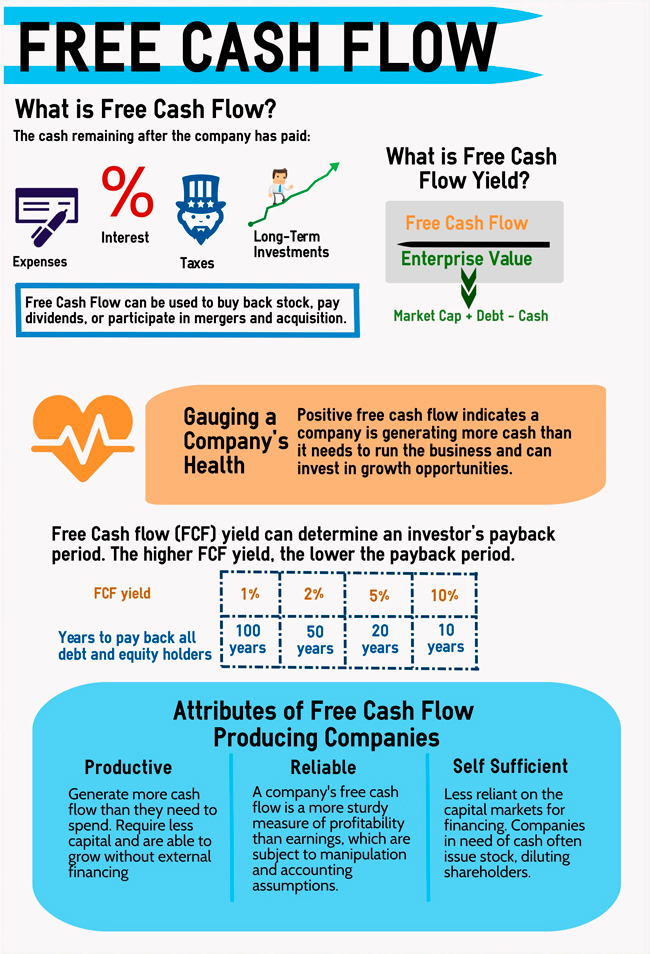

Free cash flow yield.

. Free cash flow yield free cash flowenterprise value offered the investor the highest return and the fewest periods of negative returns. Free Cash Flow Yield Free cash FLow Enterprise Value. Weve been told that T ought to be pulling in 20 billion in free cash flow and.

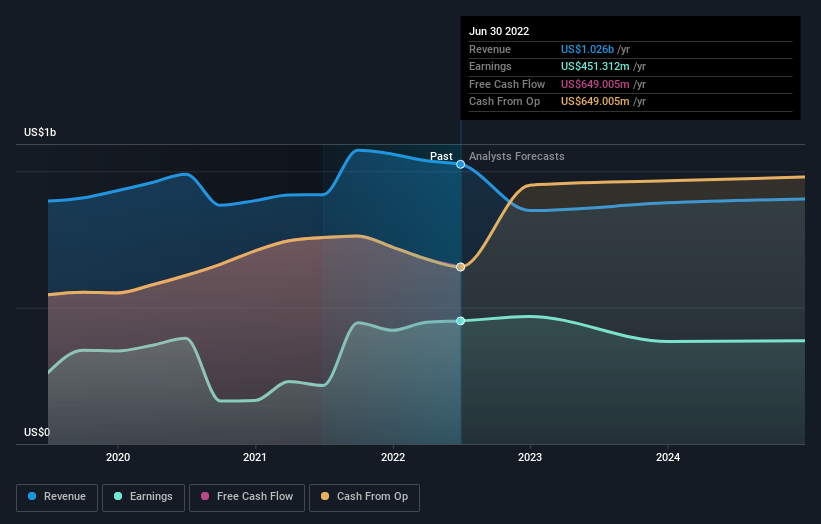

Its free cash flow per share for the trailing twelve months TTM ended in Jun. Tencent Holdingss Free Cash Flow per Share for the months ended in Jun. 2022 was 260.

In any event doing some extremely rough math we can derive free cash flow per share in 2023. Going forward there is no way to be sure that free cash. Free cash flow yield offers investors or.

We could also look at the free cash flow yield in relation to its trailing-twelve-month numbers or TTM to get the latest yield. The companys attractive Financial Strength rating is particularly strong due to its high Free Cash Flow Yield 1456 as well as its high Current Ratio 230 and Quick Ratio 156. The Enterprise Value is equal to the firms Market Capitalization Debt Cash.

A higher free cash flow yield means that the. Rated the 1 Accounting Solution. 2022 was 055.

The free cash flow yield is around 5 percent but the free cash flow growth rate is 20 to 25 percent easy. 2022 was 260. Free cash flow yield describes how much free cash flow is available in relation to a companys market capitalizationthat is relative to the companys stock market value.

Its free cash flow per share for the trailing twelve months TTM ended in Jun. Tencent Holdingss Free Cash Flow per Share for the months ended in Jun. Here is how I like to think about free cash flow yield.

Utility Dividend Leaders And Laggards Morningstar

10 Best Low Risk Investments In October 2022 Bankrate

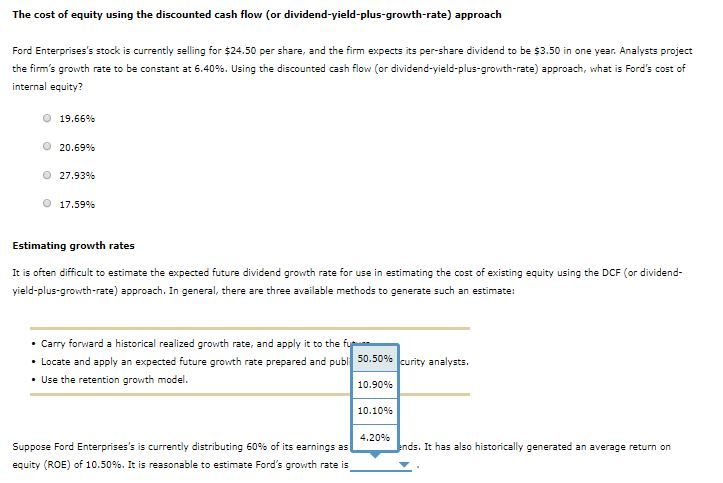

Solved The Cost Of Equity Using The Discounted Cash Flow Or Chegg Com

10 High Free Cash Flow Dividend Stocks

Andrew Kuhn Focusedcompound Twitter

Stock Valuation Using Free Cash Flow To The Firm With Python By Hugh Donnelly The Startup Medium

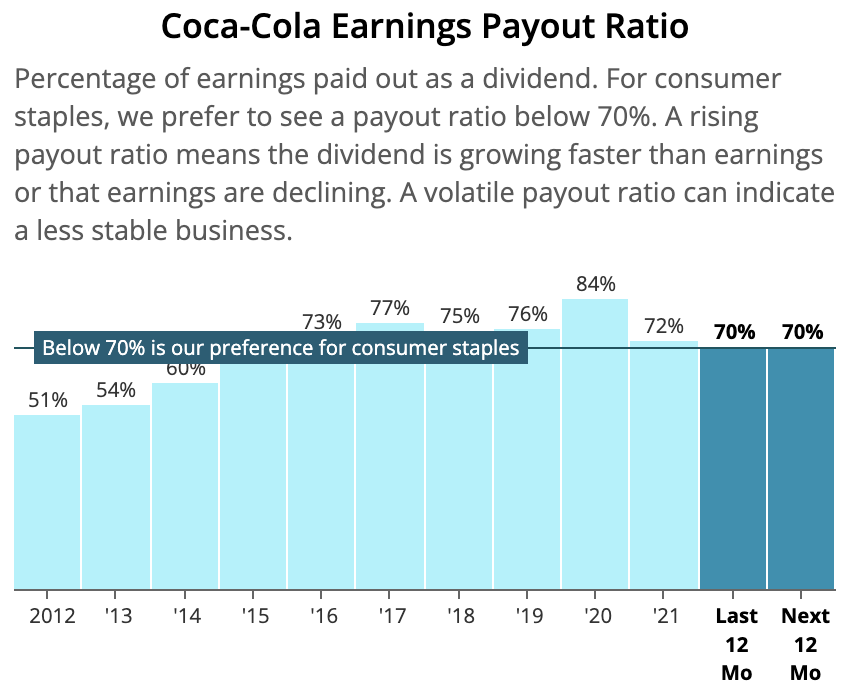

Dividend Payout Ratio How To Calculate And Apply It

Why And How To Implement A High Free Cash Flow Yield Investment Strategy Quant Investing

10 Free Cash Flow Gushers For Dividends Buybacks And More Kiplinger

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

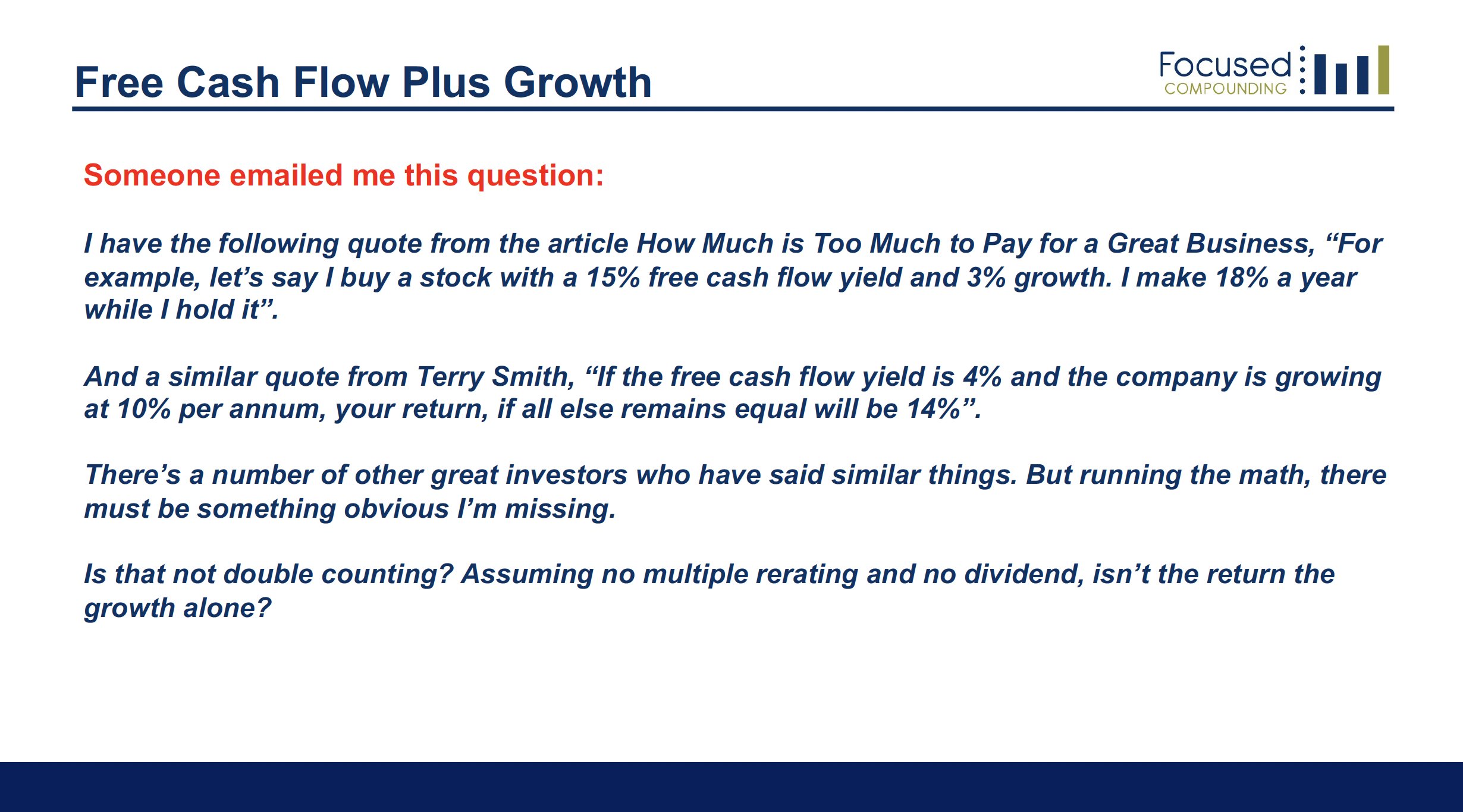

Investing For Growth How To Make Money By Only Buying The Best Companies In The World An Anthology Of Investment Writing 2010 20 Smith Terry 9780857199010 Amazon Com Books

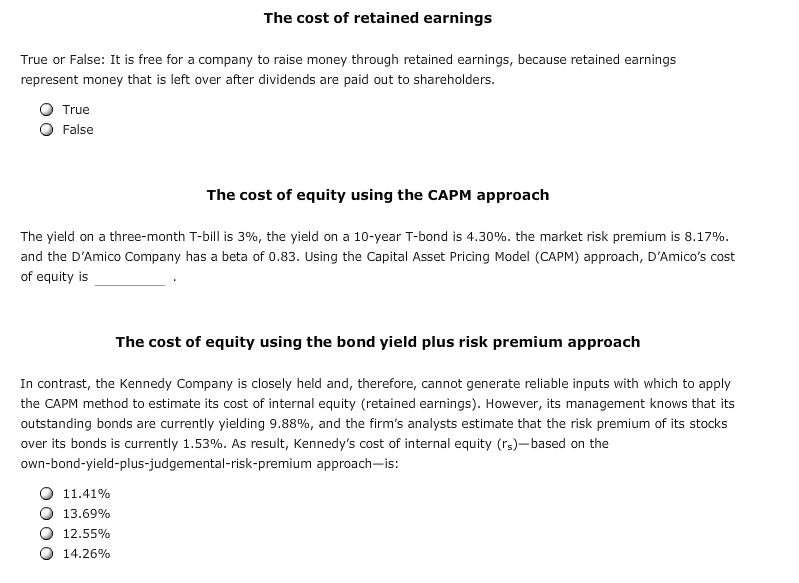

Solved 5 The Cost Of Retained Earnings The Cost Of Retained Chegg Com

All Cap Analysis Free Cash Flow Yield Falls In 2020

R Tutorial The Free Cash Flow To Equity Model Youtube

The Power Of Free Cash Flow Yield Pacer Etfs

Verizon 10 Free Cash Flow Yield And Low Valuation Make This Dividend Powerhouse A Buy Nyse Vz Seeking Alpha